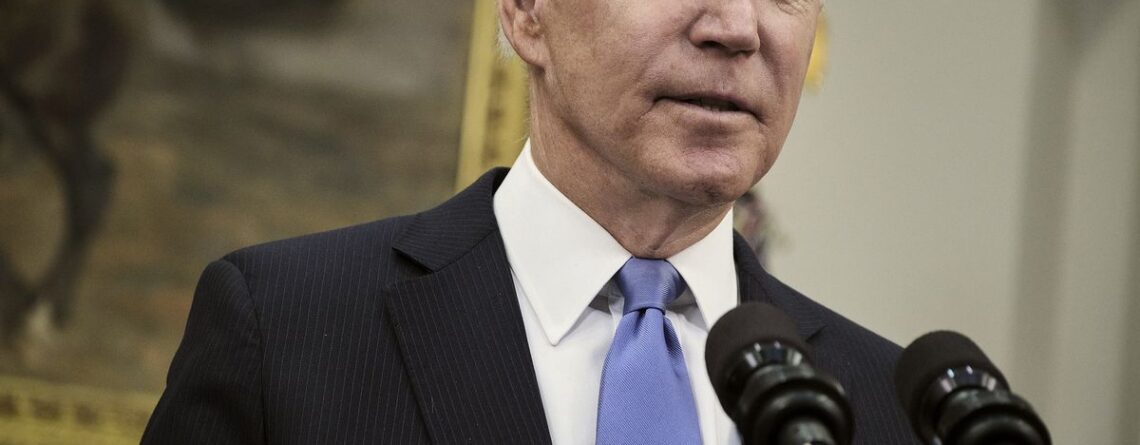

US. Biden’s Pension Rescue Seen as Bigger Help for Corporate Bonds

U.S. President Joe Biden’s planned pension rescue could result in even more money being shunted into investment-grade corporate bonds than previously thought, according to Citigroup Inc. strategists.

The Pension Benefit Guaranty Corp., which insures pensions, issued rules on Friday for bailout money for multi-employer plans that are severely underfunded. These plans can apply for rescue funds as part of the $1.9 trillion pandemic-relief bill signed into law in March.

The PBGC said that the pensions are eligible for $94 billion of assistance, which is higher than the $86 billion that Citigroup strategists estimated in May. And the government agency said it is limiting the types of investments the pensions can make with the rescue funds to individual investment-grade fixed-income securities, or funds such as exchange-traded funds, mutual funds or pooled trusts. That increases the “likelihood that funds are channeled” into high-grade bonds, Citi’s Daniel Sorid and James Keefe wrote in a note late Friday.

“For now, we continue to believe the majority of funds will be invested in investment-grade bonds,” the strategists wrote.

The 124 weakest multi-employer plans were hit hard early in the pandemic, with plunging markets resulting in their only being 34% funded, compared with 74% at the end of 2007, according to a report from actuarial firm Milliman.

Read more @Bloomberg

382 views