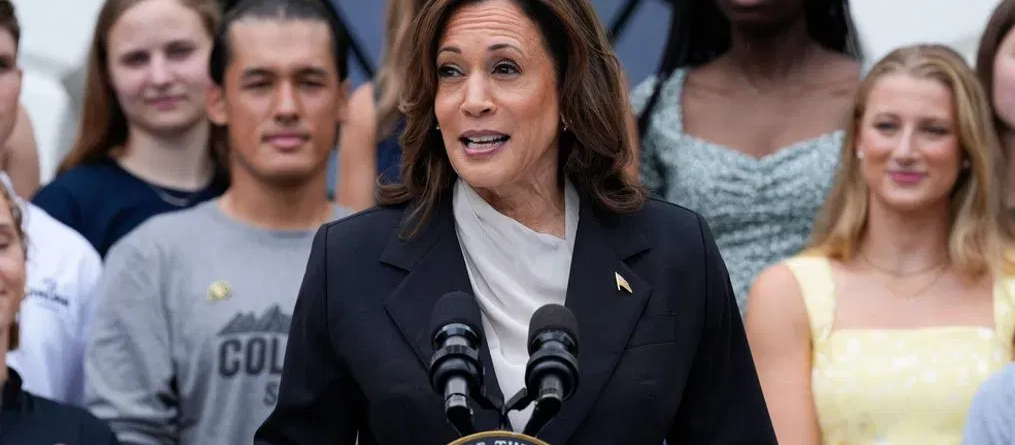

US. 5 Ways a Kamala Harris Presidency Could Impact Retirees

Vice President Kamala Harris wasn’t even a contender for the White House earlier this year, but she is now the Democratic nominee for the presidency and running neck and neck with her Republican opponent, former President Donald Trump.

If she wins, she is expected to promote policies that could affect the bottom line of millions of retirees.

“There’s been nothing that she’s said that would lead me to believe she’s a negative to retirees,” says Chris Orestis, president of Retirement Genius, a national information resource for older Americans and their families. He points to the possibility of reduced prices on prescription drugs and grocery store staples as examples.

Not everyone is convinced, though. Some financial observers believe a Harris administration could mean higher taxes for some retirees and a volatile stock market that could leave the balances of some retirement funds plummeting.

Here are five ways a Harris presidency could affect retirees:

- Extend the solvency of the Social Security trust funds

- Increase capital gains tax for investment income

- Reduce prescription costs and expand health care access

- Create stock market volatility that could affect pension funds

- Lower the price of consumer goods

Extend the Solvency of the Social Security Trust Funds

Like her opponent, Harris has vowed to protect the Social Security benefits received by millions of Americans. The two trust funds that support Social Security payments are expected to run dry by 2035, after which the program will only be able to pay 83% of scheduled benefits.

While Harris hasn’t shared specifics of how she would address the trust fund shortfall, many expect her to pick up President Joe Biden’s plan to raise Social Security taxes for higher-income workers. In 2024, only income up to $168,600 is subject to these tax withholdings, and lifting this cap would boost the trust fund balance. “Certainly, Elon Musk and Jeff Bezos could afford more,” Orestis says.

Meanwhile, the Tax Cuts and Jobs Act of 2017 will sunset in 2026. Harris may extend some provisions of that law while increasing taxes on high earners, according to Michael Foguth, president and founder of Foguth Financial Group in Brighton, Michigan. “This will be beneficial to retirees because it will be more money in the kitty,” he says. That cash could be used to shore up Social Security or other programs used by older Americans.

Increase Capital Gains Tax for Investment Income

Increased Social Security and income taxes shouldn’t affect retirees who are no longer working, but Harris’s plan for an increased capital gains tax could mean more money out of their pockets.

Currently, capital gains – the value by which an investment has increased – are subject to a 20% tax when an asset is sold. Harris would like to increase that tax to 28%, a 40% increase from the current rate. While this tax rate would not affect money kept in IRA and 401(k) accounts, it would affect retirees who have saved in taxable brokerage accounts.

It could also significantly increase taxes for retirees who sell their homes to downsize. There is a gains exclusion for taxes on a home sale – $250,000 for single taxpayers and $500,000 for couples filing jointly. Still, given the significant appreciation in housing prices in recent years, many longtime homeowners may find that their gains far exceed those limits.

Reduce Prescription Costs and Expand Health Care Access

Harris’s Medicare policy is also expected to follow suit with that of the Biden administration.

“If you want to see what people are going to do in the future, look at what they’ve done in the past,” Orestis says.

He notes that under the Biden-Harris administration, Medicare has so far negotiated the prices of 10 medications. In 2026, that is expected to save seniors $1.5 billion in out-of-pocket costs, while the savings for taxpayers are estimated at $6 billion. Harris has pledged to accelerate the pace at which prescription prices are negotiated.

Expanding access to the Affordable Care Act could be another benefit to retirees in a Harris administration, according to Foguth. Early retirees, in particular, may buy their insurance coverage on the government’s health insurance marketplace before they become eligible for Medicare.

Create Stock Market Volatility That Could Affect Pension Funds

It isn’t just capital gains taxes that Harris wants to raise. She has also proposed increasing the corporate income tax from 21% to 28%. Prior to the Tax Cuts and Jobs Act of 2017, the corporate tax rate was 35%.

While Harris’s tax proposals might not have a direct impact on retirees, “It’s a negative, I think, on the market,” Foguth says.

Some are concerned that higher taxes could lead to increased volatility in the stock market, where retirement funds have assets invested. “This could literally destroy pension funds,” says Grant Cardone, private equity fund manager with Cardone Capital, a real estate investing firm.

Lower the Price of Consumer Goods

Inflation has been foremost on many retirees’ minds as the cost of practically everything has increased in recent years. Harris has promised to crack down on price gouging and “shrinkflation” at the grocery store.

“There’s a question of how realistic it is to bring down the price of groceries,” Orestis says. However, he believes the Biden-Harris administration’s opposition to the merger of supermarket chains Kroger and Albertsons is one example of how a Harris presidency might oppose monopolistic practices that, if left unchecked, could drive up food prices.

Some worry that any attempt to control prices could lead to empty shelves at the supermarket, but others say that could depend on how pricing rules are set. Unfortunately for retirees, there is no crystal ball to know exactly how this – and other Harris policies – may be implemented and what the result will be.

Read more @money usnews