The Looming Crisis: China’s Pension System Faces a Generational Challenge

By Jessica Huang

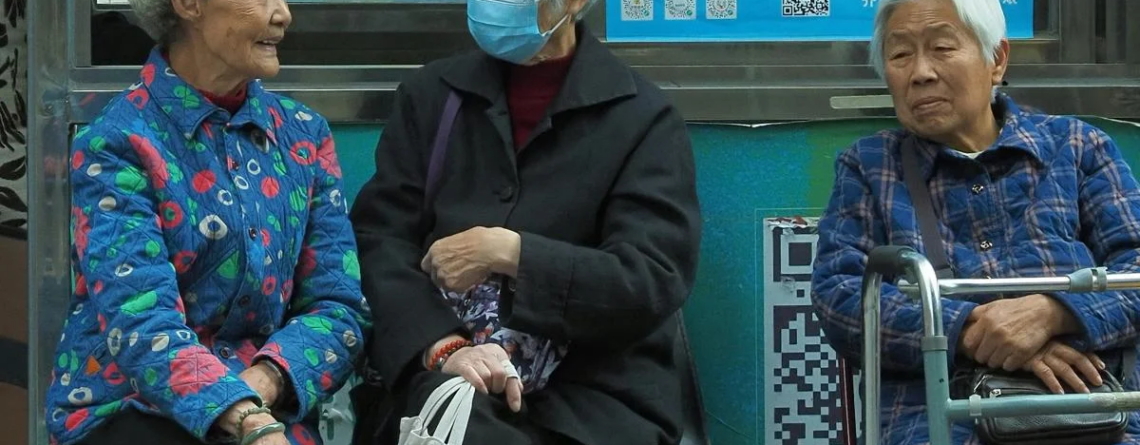

China, a nation of immense scale and ambition, is in the grip of an urgent demographic crisis. Declining birth rates and rising life expectancy are rapidly aging the population. Within the next two decades, the number of retirement-age individuals is expected to surpass the entire population of the United States, with an estimated 402 million people over 60 by 2040—28% of China’s total population. This demographic shift is straining the workforce, social services, healthcare infrastructure, and economic productivity, marking the end of China’s comparative advantage in low-cost, skilled labor.

At the heart of this looming crisis is China’s pension system, which was originally designed to support retirees but now struggles under the weight of demographic and economic changes. The system, which relied on a steady influx of workers to sustain retirees, is increasingly threatened by a shrinking workforce. While urban pension systems are more developed, rural schemes remain underfunded, and both face sustainability concerns. Efforts to address these issues—such as raising the retirement age and promoting private pension plans—have met resistance and may not be enough to avert a shortfall. However, if these reforms are successfully implemented, they could lead to a more sustainable and equitable pension system, ensuring financial security for the elderly and reducing the strain on social cohesion and economic stability. The challenge for policymakers is to balance the need for economic growth with the overwhelming task of supporting an aging society, a task that will shape the nation’s future trajectory.

Source IndraStra