U.S. corporate pension surpluses rise in February – 4 reports

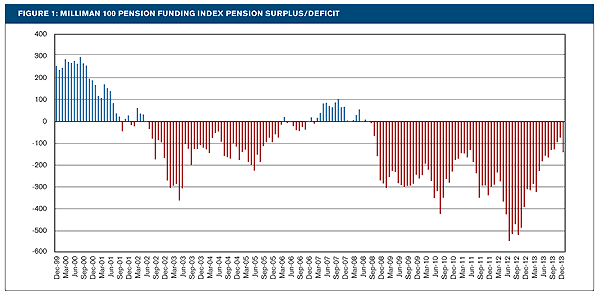

U.S. corporate pension plan funding surpluses grew in February thanks to positive returns from growth assets as well as falling liabilities, according to four new reports. Wilshire Advisors estimated the aggregate funding ratio of U.S. corporate plans reached 109.4% as of Feb. 29, up from 106% a month earlier. "U.S. corporate pension plans have maintained their overfunded status for 14 consecutive months since early 2023," said Ned McGuire, managing director at Wilshire, in a news release March 6. "February's increase in...