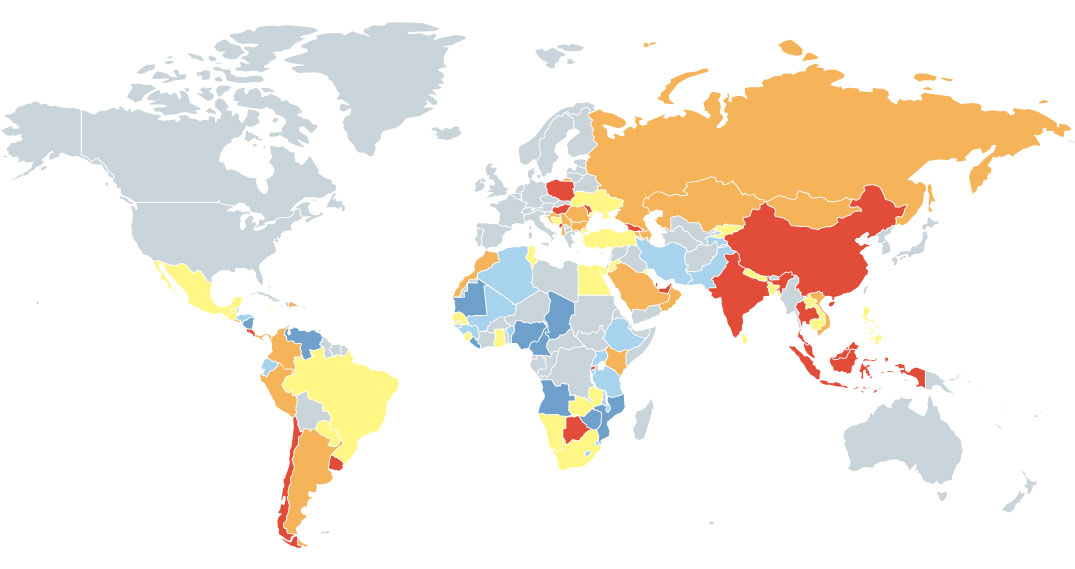

Emerging markets face a USD 5.4 trillion-per-year shortfall in savings for sustainable retirements, says Swiss Re Institute

- Emerging markets face a USD 5.4 trillion pension savings shortfall for every year of their workers' retirements, or USD 106 trillion in cumulative terms.¹ - This gap between emerging markets' pension assets and pension income need is about USD 40,000 for every worker – about 8.5 times the average annual worker's income. Read also Namibia. President signs law that consolidate regulations of all financial institutions Latin America has a pension savings gap of USD 514 billion per year, or USD 50 000 per worker on average. Brazil has the region's highest gap due to...