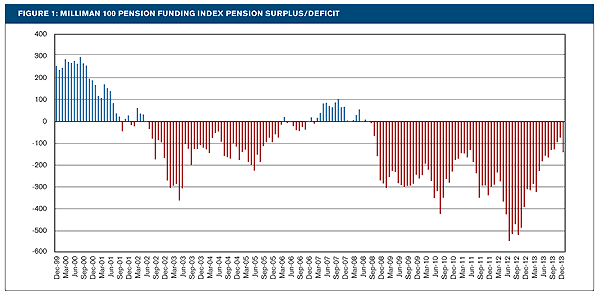

US. Corporate Pension Funding Levels Skyrocket in February

The funded status of U.S.-based corporate pension plans increased significantly in February, primarily due to a rally in technology stocks, driven by excitement over AI and semiconductors, according to industry reports. Funded status also continues to be boosted by heightened interest rates. The surplus in pension funding could have some plan sponsors considering what to do with their excess pension assets. Earlier this month, Eastman Kodak announced it would shut its investment office, shifting the management of its assets to...