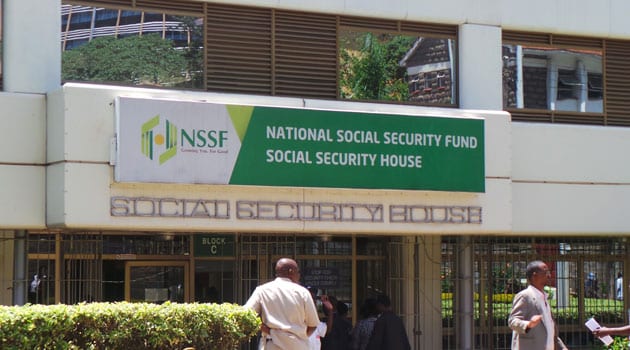

Kenya govt mulls mandatory contributions to retirement medical insurance schemes

The Kenyan government says it will review the current framework for post-retirement medical insurance schemes to make contributions to them mandatory by members and sponsors. The goal is to sustain access to healthcare services by retirees. The plan is part of proposals contained in the draft National Retirement Benefits Policy by the Retirement Benefits Authority (RBA. The draft was released for public feedback last week, according to a report by Business Daily Africa. A post-retirement medical scheme can be set up as...