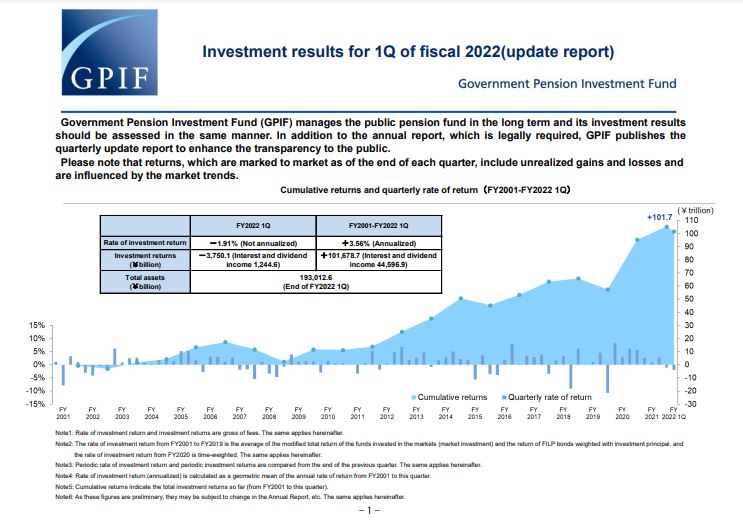

Japan births fall to record low as population crisis deepens

The number of births registered in Japan plummeted to another record low last year – the latest worrying statistic in a decades-long decline that the country’s authorities have failed to reverse despite their extensive efforts. The country saw 799,728 births in 2022, the lowest number on record and the first ever dip below 800,000, according to statistics released by the Ministry of Health on Tuesday. That number has nearly halved in the past 40 years; by contrast, Japan recorded more...