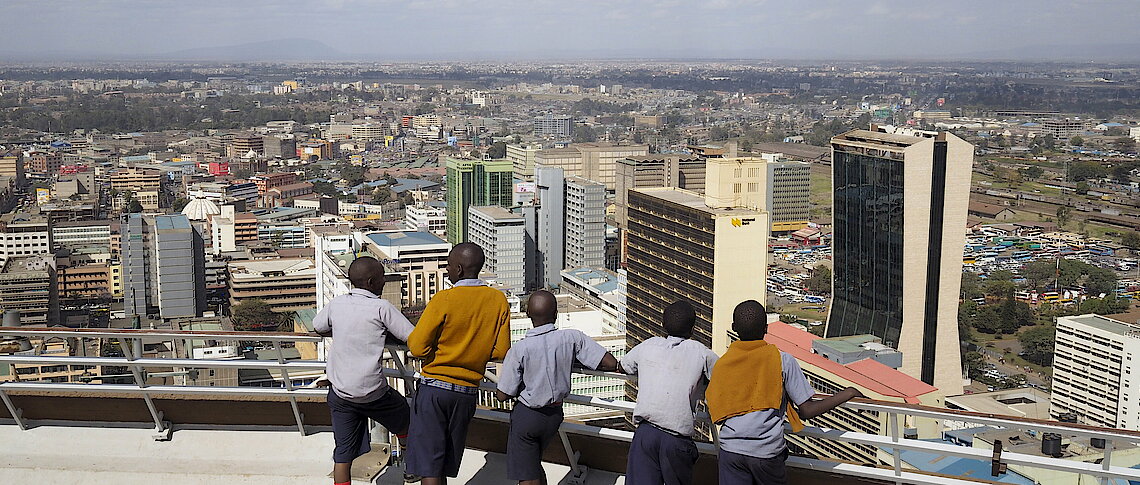

PIAFRICA 2024: Shaping The Future Of Pension Funds And Alternative Investments In Africa

PIAFRICA 2024, the 7th edition of the Pension Funds and Alternative Investments Africa Conference, is set to take place on February 28th – 29th, 2024, at the Intercontinental in Mauritius. This distinguished event brings together Pension Fund Managers, Investment Managers, Institutional Managers, and industry leaders for a groundbreaking gathering. The overarching theme of the event revolves around exploring new investment avenues, especially in alternative investments, and addressing the challenges that accompany them. PIAFRICA is not just a conference; it’s a...