Ghana. NPRA to collaborate with Goasomanhene to promote ‘one trader one SSNIT number’ campaign

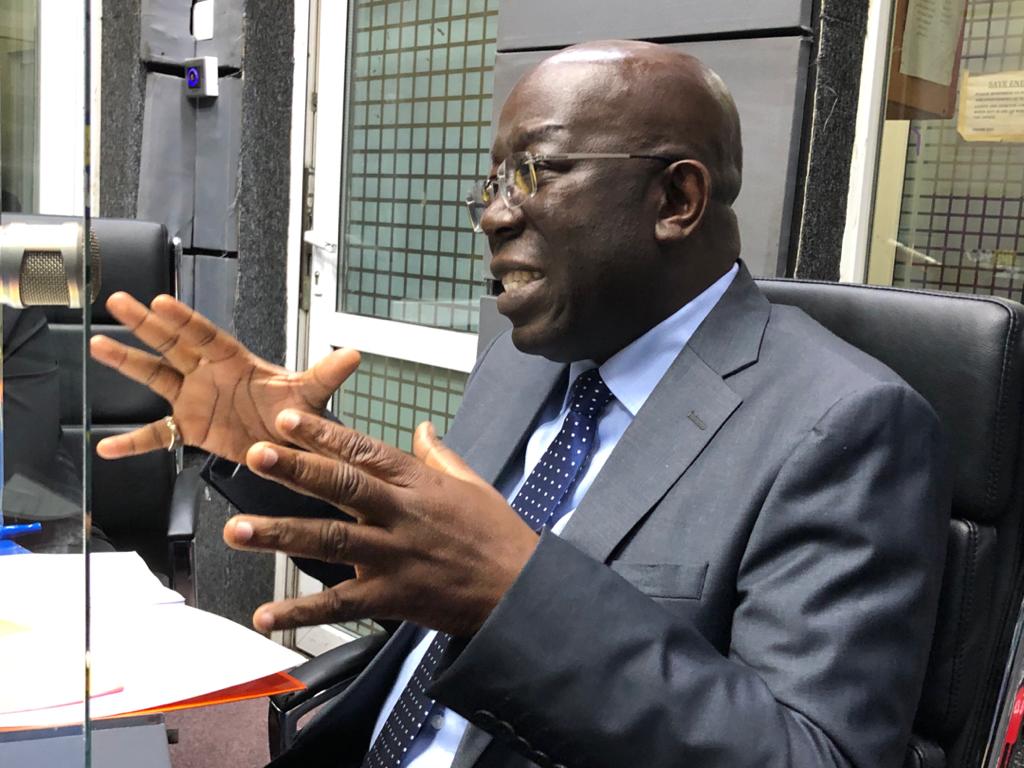

The Sunyani zonal office of the National Pensions Regulatory Authority (NPRA) has indicated its readiness to collaborate with Nana Kwasi Bosomprah, Paramount Chief of the Goaso Traditional Area on his 'one trader, one SSNIT number' campaign. The idea of the Paramount Chief is to encourage every trader have a Social Security and National Insurance Trust (SSNIT) number and contributed to the scheme. The collaboration became a reality when Mr David Tetteh-Amey Abbey, the Deputy Chief Executive Officer of the NPRA...