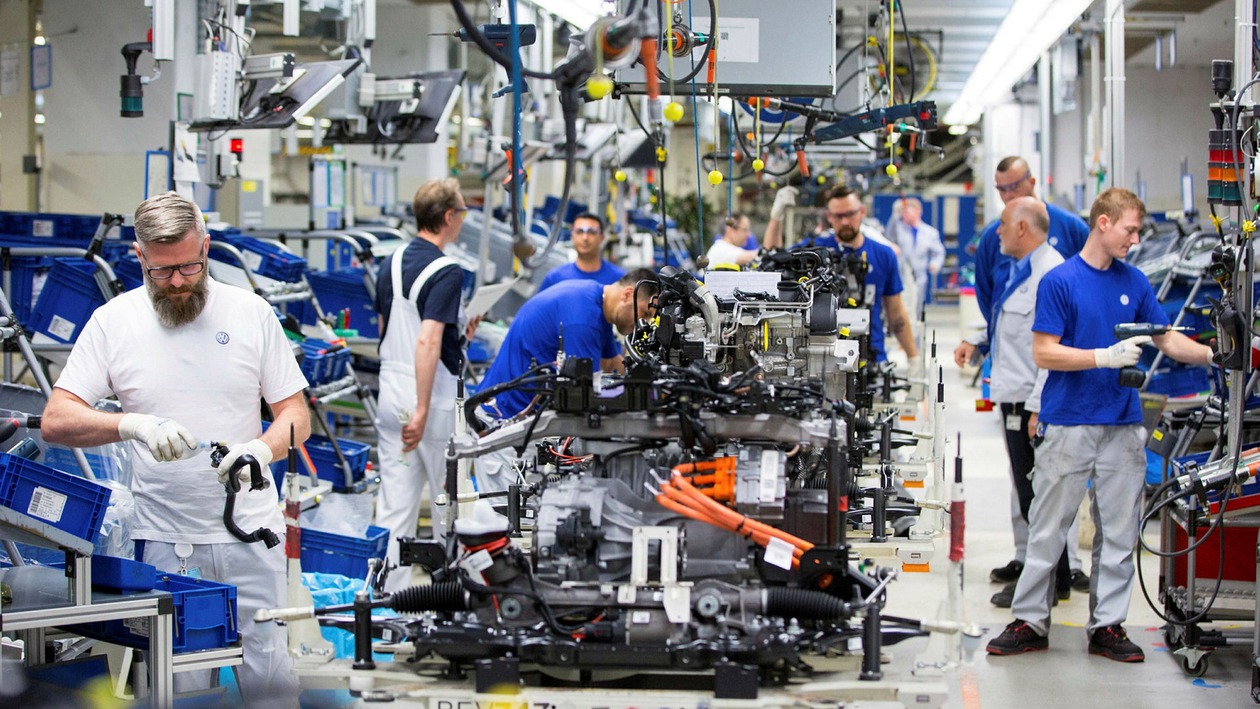

Aging Germany Is Running Out of Workers, Putting Europe’s Largest Economy at Risk

Germany has long been ahead of the curve as a source of technical innovation and manufacturing. Now it is leading much of the developed world toward a demographic cliff edge that could put a damper on Europe’s largest economy, raising pressure on its pension system and pushing inflation higher for years to come. Economists forecast that Germany’s workforce could peak as soon as 2023 and then shrink by up to five million people by the end of the decade. While...