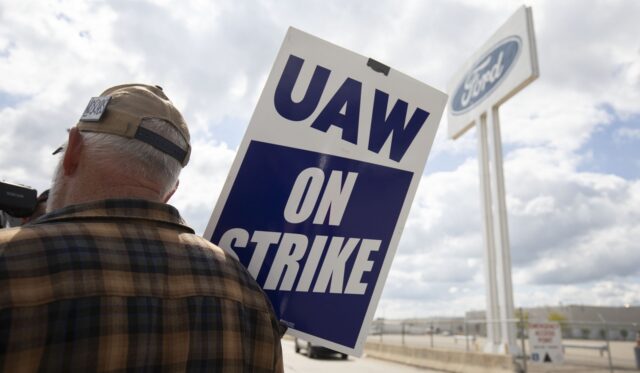

US auto union strike: Carmakers say they cannot afford UAW demands

The United Auto Workers’ historic standoff with Detroit’s three carmaking giants is centered on an age-old tension: The union says corporate greed is keeping workers from earning fair wages, while Ford Motor Co., General Motors Co. and Stellantis NV say they can’t afford union demands. While both arguments have some merit, one fact stands out: The 10 individuals who’ve served as chief executive officers of the companies since 2010 have collected more than $1 billion of compensation. Meanwhile, wages of...