Impact of COVID-19 on the FinTech Industry

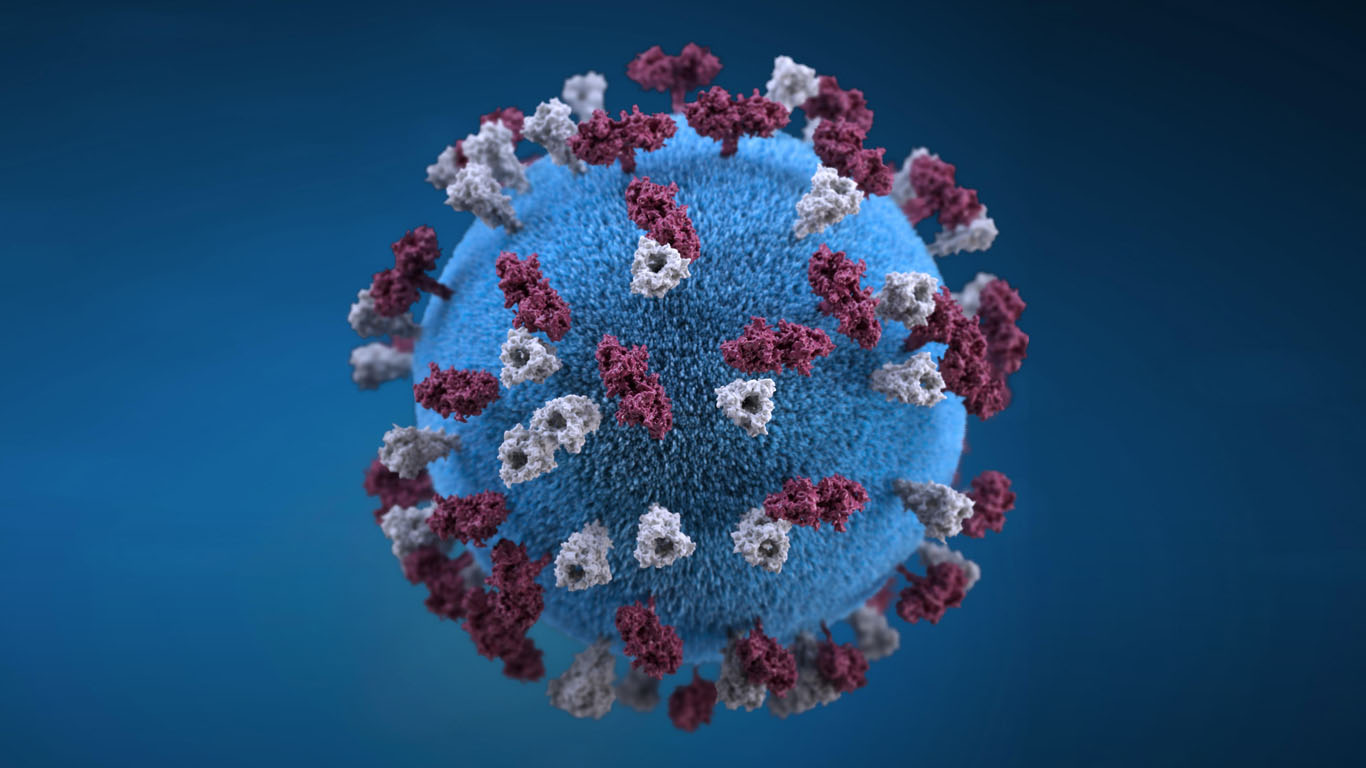

In a matter of months, the COVID-19 pandemic has forever changed our world. What started as a global standstill is quickly turning into a race to adapt as new data pours in, and we get a better vision of our new reality. With global productivity still in recovery, we are facing an unprecedented economic downturn that will impact the financial stability of individuals and businesses for months and even years to come. Though short-term recovery plans will enable many...