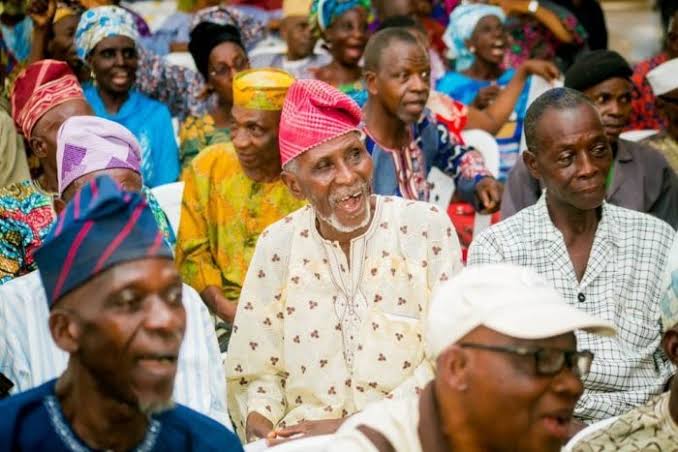

“Pensioners Live in Fear”: Only 1 Out of 10 Nigerians Has Access to Pensions

Hamisu Bala Idris, the managing director of Norrenberger Pensions Limited, has exposed the extent of pension reach in Nigeria. The disclosure follows several reports of pensioners across different parts of the country regularly lamenting the non-payment of their pensions, especially by state governors. Idris, during a retirement planning seminar organised to empower individuals close to retirement and retirees for a financially-secured future after retirement in Abuja, disclosed that only 10% of Nigerians have access to pension schemes, as reported by Vanguard. The...