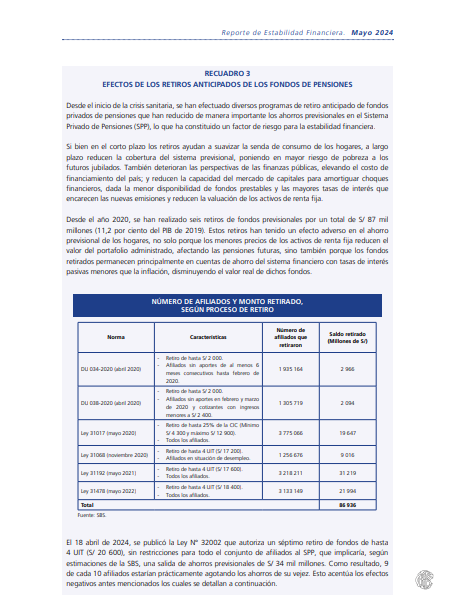

Efectos de los Retiros Anticipados de los Fondos de Pensiones

Por Banco Central de Reserva del Perú Desde el inicio de la crisis sanitaria, se han efectuado diversos programas de retiro anticipado de fondos privados de pensiones que han reducido de manera importante los ahorros previsionales en el Sistema Privado de Pensiones (SPP), lo que ha constituido un factor de riesgo para la estabilidad financiera. Si bien en el corto plazo los retiros ayudan a suavizar la senda de consumo de los hogares, a largo plazo reducen la cobertura del sistema previsional, poniendo en...