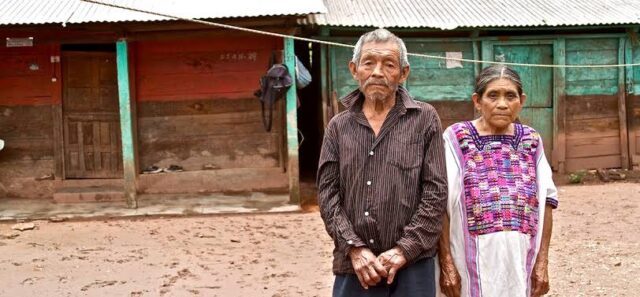

Cuidados de la vejez y oferta laboral femenina en América Latina

Por Elisa Failache Mirza, Noemí Katzkowicz, Fabrizio Méndez Rivero, Cecilia Parada Larre B. & Martina Querejeta R El envejecimiento poblacional se posiciona como un importante cambio demográfico. Este trabajo analiza las características de los adultos mayores en situación de dependencia, las estrategias de cuidado y el perfil de personas cuidadoras para Chile, Colombia, Paraguay, El Salvador y Uruguay. La población en situación de dependencia fun-cional es mayoritariamente femenina y mayor de 75 años. Entre un 54 % y un 70...