Swedish watchdog to scrutinize Alecta over U.S. bank investments

Sweden’s financial watchdog will investigate Stockholm-based pension fund Alecta’s risk management in the wake of its investments in collapsed U.S. banks.

Finansinspektionen, the Financial Supervisory Authority of Sweden, will in particular investigate how Alecta measures risks in various investments, the watchdog said in a notice Thursday.

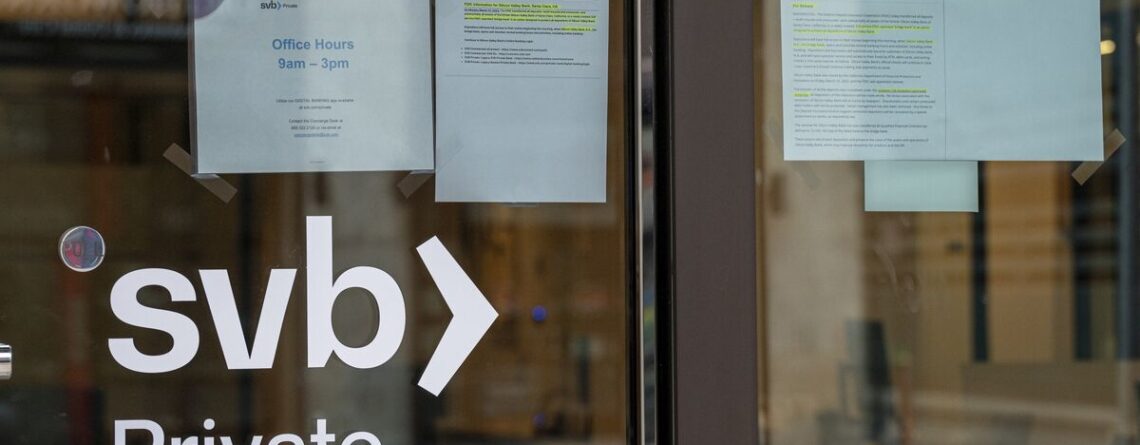

The starting point for its investigation is the 1.12 trillion Swedish kronor ($108.4 billion) pension fund’s investments in Silicon Valley Bank, First Republic Bank and Signature Bank. The pension fund had a total 12 billion kronor exposure to SVB and Signature Bank, which were written down to zero, and also sold a 9.7 billion kronor holding in First Republic Bank at a loss. The pension fund sold its exposure in March for 7.3 billion kronor.

The FSA will review whether Alecta followed internal and external rules regarding its investment in the U.S. banks, the FSA said.

“Our task is to prevent and remedy problems in the financial market. We will now investigate whether Alecta has had control over its risks in the manner required by the regulations. Basically, it’s about securing and protecting pension savers’ money,” said Ellinor Samuelsson, head of risk supervision insurance at the FSA, in a translation of the notice.

The FSA said it chose to launch the investigation having questioned and met with Alecta, as well as reviewed documentation related to the investments, over recent weeks.

“We have the utmost respect for the fact that the Swedish Financial Supervisory Authority initiates this investigation, and we will of course cooperate fully with them moving forward,” a spokesman for Alecta said in an email.

In the weeks following the losses, Alecta CEO Magnus Billing left the pension fund as part of the board’s work to restore trust. Mr. Billing had conducted an investigation into the pension fund’s investment strategy, risk allocation and mandate for asset management, concluding that the investments made were not in breach of any rules or mandates.

Other changes saw equities chief Liselott Ledin replaced by board member Ann Grevelius, and the pension fund’s approach to equity investments was altered to reduce the risk associated with holding high stakes in individual foreign companies.

Read more @Pensions&Investments

240 views