Public Pension Funding Index November 2024

By Rick Gordon & Rebecca A. Sielman

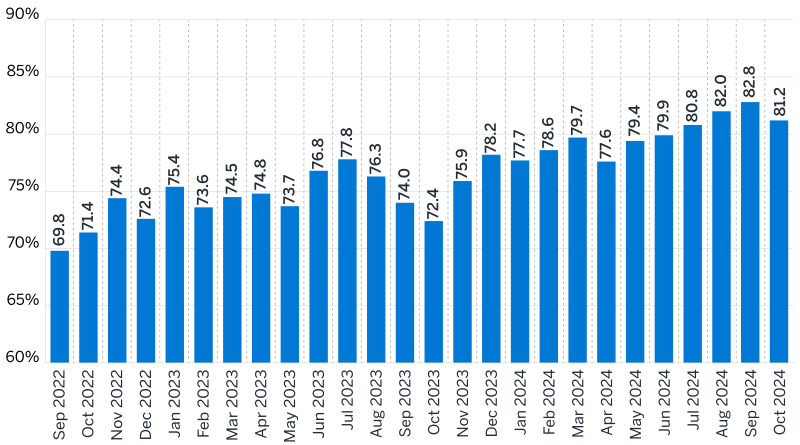

October 2024 broke the five-month positive investment return streak for public pensions, prompting a decrease in the estimated funded status of the 100 largest U.S. public pension plans from 82.8% as of September 30, 2024, to 81.2% as of October 31, 2024, as measured by the Milliman 100 Public Pension Funding Index (PPFI). We estimate a calendar year-to-date investment return of 7.6% through the end of October.

We have projected the aggregate funded status forward from October 31, 2024, to October 31, 2025, under three scenarios. The baseline scenario assumes each plan’s future investment returns equal that plan’s current reported interest rate assumption (median rate = 7.0% in this study). The “optimistic” and “pessimistic” scenarios assume each plan’s investment returns are 7% higher and lower, respectively, than that plan’s current reported interest rate assumption.

Get the report here