Pensioners Without Borders: Agglomeration and the Migration Response to Taxation

By Salla Kalin, Antoine Levy & Mathilde Munoz

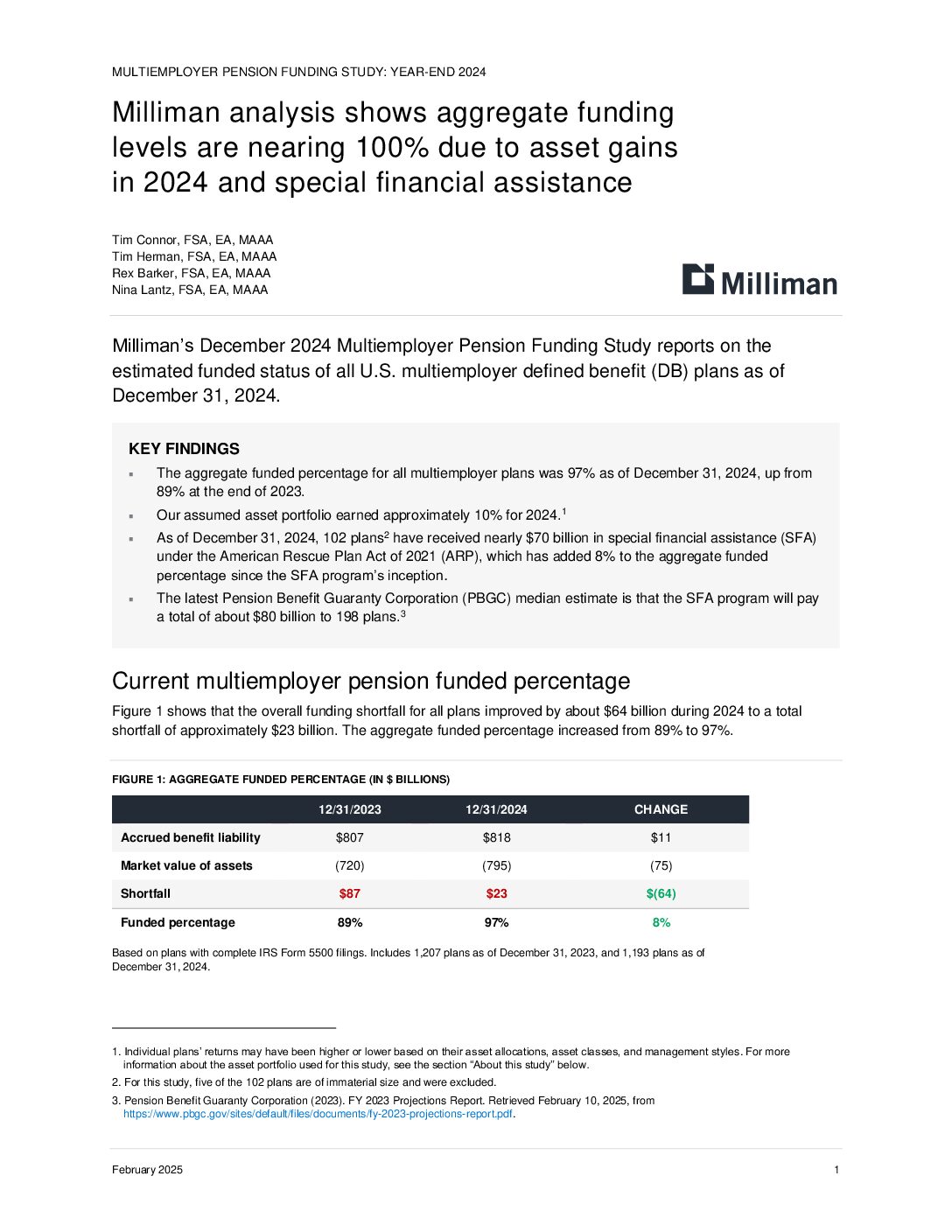

This paper investigates whether and why pensioners move across borders in response to tax rate differentials. In 2013, retirees relocating to Portugal became eligible to a full tax exemption of foreign-source pensions. Contrary to the broadly held belief that seniors “age in place”, we find substantial international mobility responses to the reform, concentrated among wealthy and educated pensioners in higher-tax origin countries. The implied migration elasticity of the stock of foreign pensioners to the net-of-tax rate is large (between 1.5 and 2) and increases at longer horizons. Tax-induced retirement migration clusters in space, and exhibits amplification and hysteresis patterns consistent with agglomeration through endogenous amenities. We show such forces theoretically and empirically have significant implications for optimal tax rates, and for the limited efficacy of unilateral policy responses to tax competition, like the source-based taxation of pensions.

Source SSRN