Pension Fund Statistics – Q3 2022

By Central Bank of Ireland

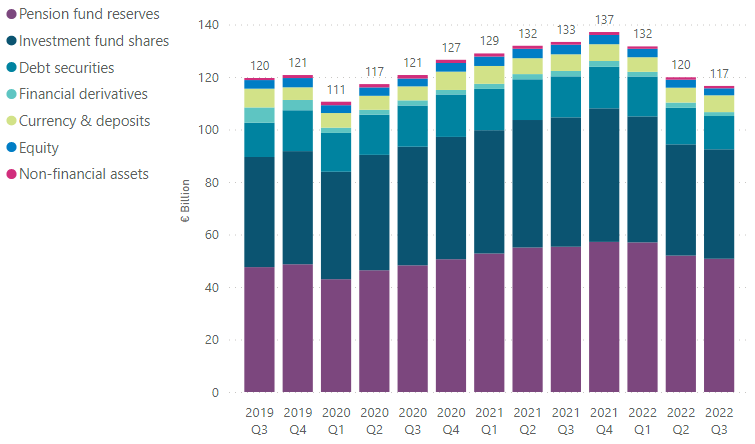

Total assets of the Irish pension fund sector fell by 2.5 per cent (€3 billion) over Q3 2022 to stand at €117 billion. This continues a trend across the year to date with assets down 14.9 percent on the series high of €137 billion at end-2021.

Technical reserves relating to pension entitlements of Irish pension funds decreased in Q3 2022. 1 Defined contribution (DC) technical reserves fell as a result of falls in corresponding asset values. Defined benefit (DB) technical reserves fell predominantly due to increases in discount rates.2 The reduction in liabilities exceeded the fall in assets, contributing to a further improvement in sector net worth.

All of the main pension fund asset types experienced negative price changes throughout 2022. This quarter has seen a lesser decline across debt securities, investment funds and pension fund reserves relative to Q2 2022. Equities have continued to experience larger falls.

Read book here

294 views