Pension Fund Industry in Mexico: Analyzing the S&P/BMV Mexico Target Risk Index Series across Different Economic Crises

By Jaime Merino

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

It is unnecessary to give an update on today’s economic situation since most already have a wealth of information over the repercussions of the COVID-19 pandemic.

I will instead focus on another major concern: how have pension funds performed, and furthermore, are there similarities in how they have performed during other crises? After the S&P/BMV IPC dropped 16.38% from its highest monthly return posted in the past 10 years, the S&P/BMV Sovereign MBONOS Bond Index fell 0.72% and the S&P/BMV Sovereign UDIBONOS Bond Index followed with a loss of 3.10%.

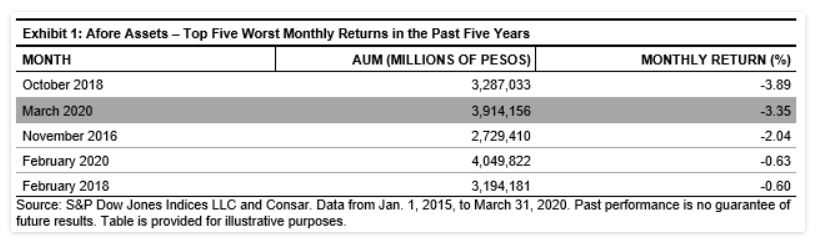

In this environment, we would expect that pension funds would have their worst month, or even their worst quarter. Using data provided by Consar (available since December 2015),[1] we can see that Afore assets dropped 3.35%, the second-worst month in the past five years, with October 2018 taking the lead with a loss of 3.89%, as shown in Exhibit 1.

Read more @S & P Global