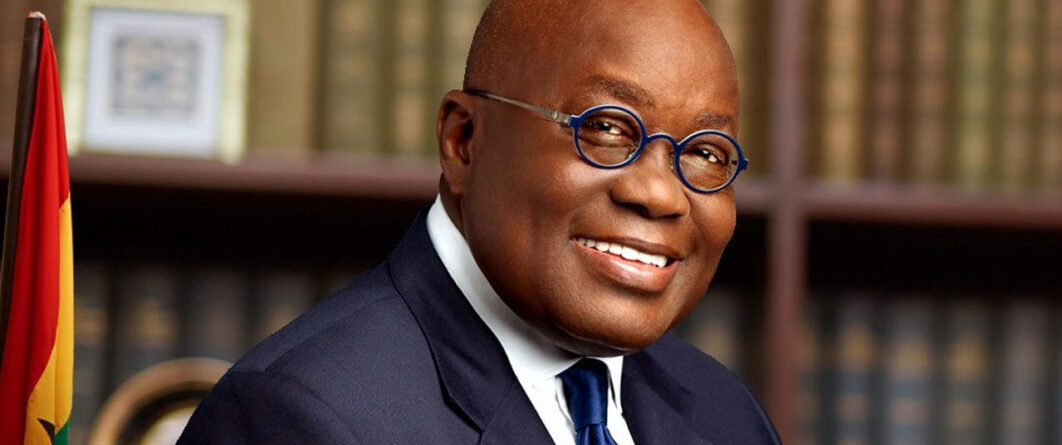

No haircuts for pension funds or anybody, says Ghana’s president

Ghanaian President Nana Akufo-Addo ruled out losses for bond investors as a result of negotiations with the IMF for a $3bn bailout.

Talks with the IMF are “going well”, Akufo-Addo said in a speech broadcast on Sunday in the capital, Accra. The president criticised speculation in the West African nation predicting a so-called haircut for investors, which he said has triggered renewed selling of the cedi.

“No individual or institutional investor, including pension funds, in government Treasury bills or instruments will lose their money as a result of our ongoing IMF negotiations,” he said. “There will be no haircuts.”

A follow-up IMF mission is expected in Ghana within weeks to continue talks that began in July for a three-year loan programme. Should the Washington-based lender deem that Ghana’s 393.4-billion cedis ($28bn) of debt is unsustainable, the authorities will have to take remedial action, including restructuring its liabilities, to qualify for assistance, the IMF said in September.

The finance ministry said the government and the IMF are both committed to reaching an agreement on a framework and policies for an IMF-backed programme “as soon as feasible”, according to a statement published on Monday.

Bond prices across Ghana’s dollar-denominated securities fell by 7.35am in Accra. The yield on dollar-debt due in 2032 rose 60 basis points to 33.1% based on Composite Bloomberg Bond Trader pricing. That is near a record high of 33.4% reached on October 25.

Akufo-Addo said Ghana will seek to restore financial discipline by reducing total public debt to 55% of GDP by 2028 and pegging external debt-servicing costs to no more than 18% of annual revenue by the same year. Ghana also plans to review its foreign-exchange management for imports including rice, poultry and vegetable oil in May.

No reference was made in Akufo-Addo’s speech to finance minister Ken Ofori-Atta, who has faced calls by legislators for his dismissal over the nation’s economic crisis and a slide in the currency. Appointed in 2017, the minister oversaw economic growth of at least 6% for three years until the coronavirus pandemic and disruption caused by Russia’s invasion of Ukraine destabilised the economy.

An exit of foreign investors prompted by concerns over the sustainability of the country’s debt has contributed to a 56% depreciation of the cedi against the dollar this year, making it the world’s worst-performing currency. That in turn has accelerated inflation, which rose for 15 consecutive months until the statistics office changed the way it measures price growth. Annual inflation stood at 37.2% in September.

“I cannot find an example in history when so many malevolent forces have come together at the same time,” Akufo-Addo said.

The central bank has increased its benchmark lending rate by 10 percentage points this year to 24.5% in a bid to tame price growth, bolster the currency and lure back investors. That has led to increased borrowing costs for traders.

Read More @businesslive

[views