Jamaica. Ageing women face pension crisis

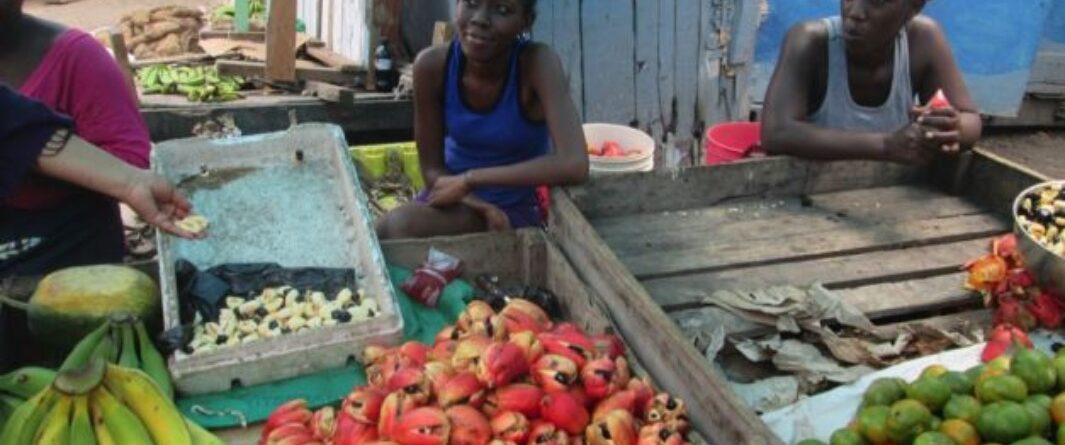

Kingston vendor Annie Ivey is just two years short of being 80 and has been working her entire life in different low-paying jobs but has never had a pension plan.

She has no clue when she will retire.

“Anytime mi cyah go nuh more. Mi nuh sick yah now, so me can work,” said Ivey, who has been vending in the Cross Roads Market for more than two decades.

Ivey is among thousands of older Jamaican women who are facing the risk of old-age poverty caused by a range of socio-economic factors, including the gender wage gap, the burden of unpaid care, fragmented work history, and part-time employment.

The septuagenarian laboured as a domestic worker in her earlier years and an employee under government-run crash programmes in the 1980s.

“Me used to sweep road every morning and me nah get no pension from that,” she lamented.

According to Ivey, after meeting her immediate needs, there was hardly any money left to put aside in the bank from her weekly earnings at the market. Added to that, she said banks are offering minuscule interest rates and their service charges are sky-high.

Her story is similar to that of Paulette Muir, a 65-year-old hairdresser, and Dorothy Marrah, a 1940s baby, who is also a vendor.

“Back in those days, I wasn’t thinking about getting older, and I didn’t know about NIS either,” Muir said of the National Insurance Scheme.

The NIS is a compulsory contributory-funded social-security scheme covering all employed persons in Jamaica. It offers some financial protection to the worker during retirement or a period of income loss, arising from injury on the job, sickness, or death of a breadwinner.

Read more @The Gleaner

261 views