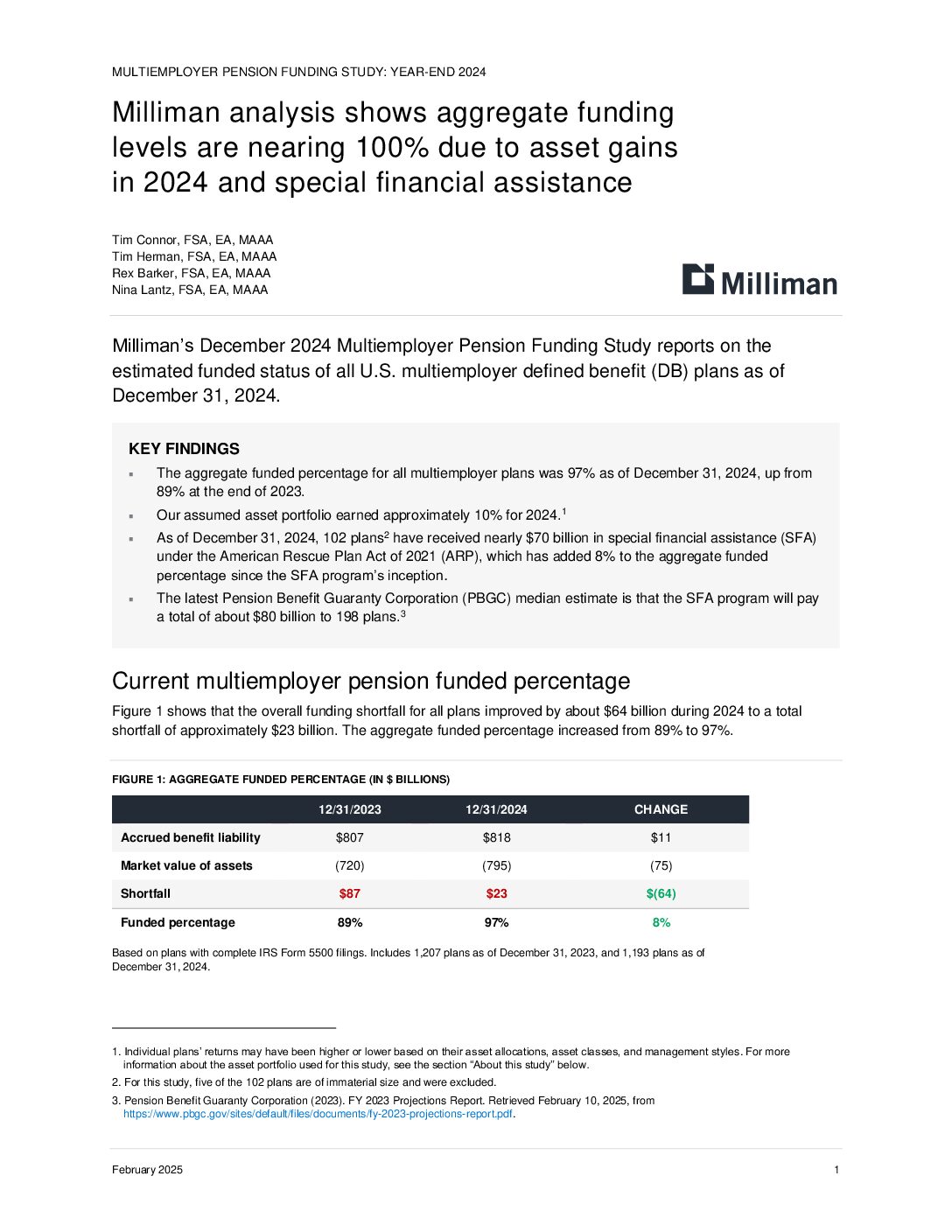

Global Pension Assets Study. 2024

By Thinking Ahead Institute

The study covers 22 pension markets in the world (P22). They have pension assets of USD 55,688 bn. The P22 markets are: Australia, Brazil, Canada, Chile, China, Finland, France, Germany, Hong Kong, India, Ireland, Italy, Japan, Malaysia, Mexico, Netherlands, South Africa, South Korea, Spain, Switzerland, UK, US.

91% of P22 assets are in the seven P7 largest markets. A deeper analysis is performed for the P7, with assets of USD 50,842 bn. P7 markets are: Australia, Canada, Japan, Netherlands, Switzerland, UK, US.

Outside the P22 we estimate there is an additional USD 3-5 tn of pension assets.

Read the complete report here