Global top 300 pension funds

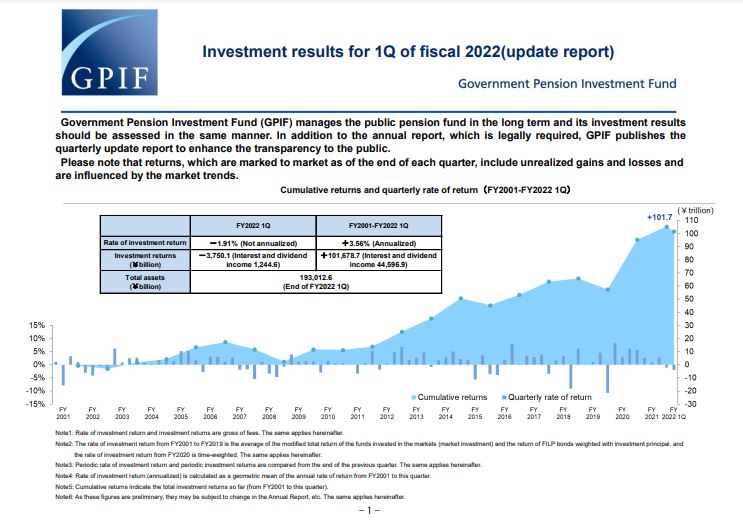

By Thinking Ahead Institute and Pensions & Investments Pension fund industry trends Growth headwinds test financial and sustainability mandate resilience Has the macro reality shifted from ‘lower-for-longer’ to ‘end-of-cheap-money’? The last decade’s fear of deflation has been replaced by significantly higher inflation. A steep rate hike cycle has led to more interest rate volatility and is placing pressure on pension funds to deliver sufficient risk-adjusted returns. Pension funds are expected to face elevated macro uncertainty over the short term. The industry has...