Canada. Ontario’s newest university pension plan has a chance to get divestment right

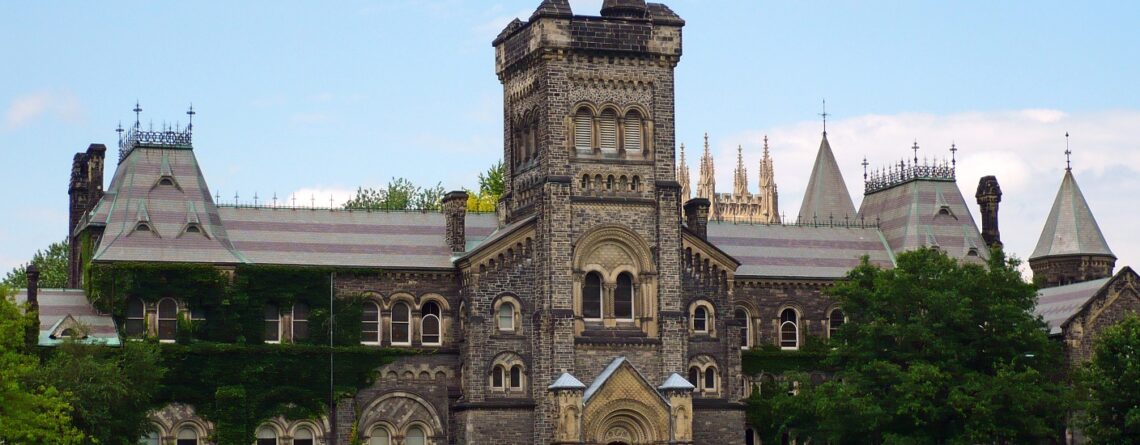

On July 1, the University Pension Plan (UPP) will take responsibility for the pensions of faculty and staff at three of Ontario’s biggest universities: Guelph, Queen’s and Toronto. The UPP launch comes fast on the heels of the International Energy Agency’s (IEA) recent bombshell report that makes a powerful case for decarbonizing the global energy system. The usually conservative and historically pro-fossil fuel body released its new Net‐Zero Emissions by 2050 Scenario that charts a pathway to limit global temperature rise to 1.5 C. Following this approach, the IEA requires an immediate halt to new investments in oil and gas.

In this context, the formation of the UPP creates an unprecedented opportunity to redefine best practices in the pension sector and to determine a truly forward-looking fund. To further this goal, a coalition of faculty and staff at all three universities is calling on the UPP to protect our pensions, demonstrate clear leadership on climate change and reduce financial risk by developing an investment strategy that aligns with a 1.5 C pathway. This must preclude new investments in fossil fuels, a managed divestment of existing ones and setting clear and transparent targets towards decarbonizing the fund over the next two decades.

There is much to be gained from such an initiative. Our universities position themselves as global leaders in sustainability research and teaching. Yet their respective pensions, endowments and other financial funds remain invested in extractive industries. This can and must change. Previous opposition to divestment frequently rested on the idea that attending to fiduciary duty — i.e., ensuring strong returns — ruled out such a strategy. Yet this argument is perilously out of touch with market trends and recent evidence. Numerous studies now show that funds divested from fossil fuels have benefited from that decision. BlackRock — the world’s largest asset manager — recently created a comprehensive study of three divestment strategies. Its conclusion was unambiguous: all three pathways would have outperformed standard performance benchmarks over the past five years.

Read more @National Observer