Public Pension Funding Index January 2024

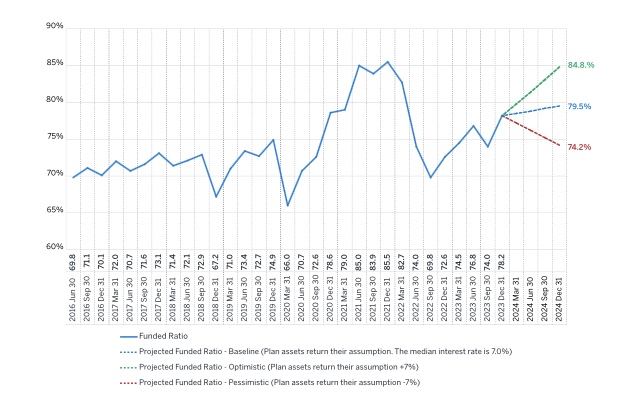

By Rebecca A. Sielman & Richard L. Gordon Two consecutive months of positive market performance in November and December 2023 pushed the funded status of the 100 largest U.S. public pension plans to its highest point of 2023. The plans’ estimated funded status increased from 72.4% as of October 31, 2023, to 75.9% as of November 30, 2023, and further increased to 78.2% as of December 31, 2023, as measured by the Milliman 100 Public Pension Funding Index (PPFI). Get the...