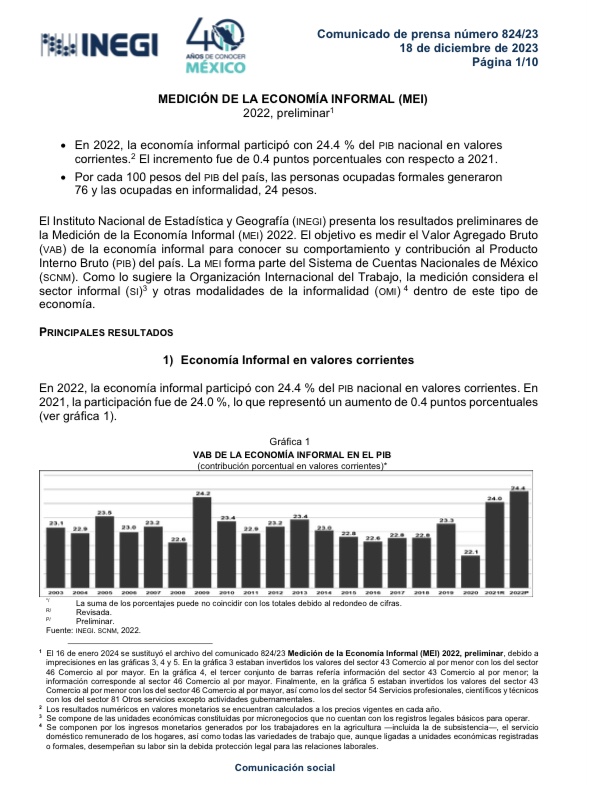

Fertility, mortality, migration, and population scenarios for 195 countries and territories from 2017 to 2100: a forecasting analysis for the Global Burden of Disease Study

By Prof Stein Emil Vollset, DrPH, Emily Goren, PhD, Chun-Wei Yuan, PhD, Jackie Cao, MS, Amanda E Smith, MPA, Thomas Hsiao, BS, Catherine Bisignano, MPH, Gulrez S Azhar, PhD, Emma Castro, MS, Julian Chalek, BS, Andrew J Dolgert, PhD, Tahvi Frank, MPH, Kai Fukutaki, BA, Prof Simon I Hay, FMedSci, Prof Rafael Lozano, MD, Prof Ali H Mokdad, PhD, Vishnu Nandakumar, MS, Maxwell Pierce, BS, Martin Pletcher, BS, Toshana Robalik, BSc, Krista M Steuben, MS, Han Yong Wunrow, BSc,...