Kenya. Pension returns negative on falling share prices

Kenyan pension schemes have registered negative returns in the quarter ended September on wider losses from equities, a new survey shows.

According to the Performance Investment Management Survey by South Africa-based investment firm RisCura, the weighted average return of surveyed schemes was posted at negative 3.06 percent in the quarter from a return of 0.18 percent in the previous quarter.

The weighted average return from equities deteriorated to a loss of 10.95 percent from losses of 4.27 percent in the quarter ended June, driving the drag on the scheme’s total performance.

Equally, fixed income portfolios were down in the period, and posted a weighted average loss of 1.62 percent in the quarter from gains of 0.8 percent in the previous quarter.

“The decrease in returns was observed in fixed income and offshore portfolios which decreased by about 1.78 and 1.52 percent respectively, from the last quarter,” notes the survey.

Despite falling, returns from offshore investments have remained resilient at a weighted average return of 1.79 percent in the third quarter from 14.9 percent in the second quarter.

The survey, which covered 397 schemes shows the fund value of the schemes amounted to Sh944 billion, a 3.9 percent decrease in contrast to Sh982 billion in the second quarter.

“The assets under management excluding property, decreased from Sh882 billion in Q2 2023 to Sh850 billion in Q3 2023,” the survey added.

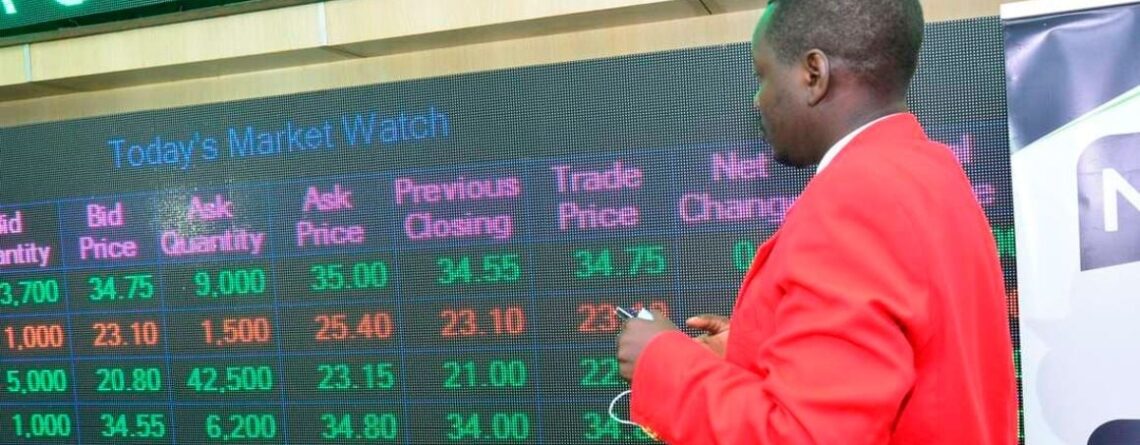

The fall in returns from equities is largely attributable to falling stock prices at the Nairobi Securities Exchange with the NSE all-share index declining by 11.01 percent in the third quarter to 95.22 points.

Market capitalisation in the same period fell to Sh1.4 trillion from Sh1.6 trillion in June. Under fixed income meanwhile, pension schemes which are investors in bonds have been exposed to paper losses as bond prices fall amidst rising interest rates on government securities at both the primary and secondary markets.

According to the survey, pension schemes have turned to conservative investment strategies amidst market turmoil.

The number of schemes deploying a conservative investment approach, defined as schemes with more than 65 percent of assets in fixed income increased by 1 to 345 in the quarter.

The conservative schemes had Sh714 billion in assets under management in the quarter.

Twenty-seven schemes meanwhile employed a moderate investment strategy investing between 45 and 65 percent of assets in fixed income in the quarter and had Sh82 billion in assets under management.

A further 25 schemes pursued an aggressive investment strategy, deploying less than 45 percent of assets in fixed income, and had a combined Sh53 billion in assets under management.

The reduced returns by pension schemes mean retirees in the schemes would earn less were the entities to make a distribution in the period.

Read more @businessdailyafrica