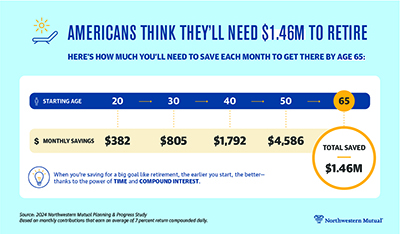

Planning & Progress Study 2024

By Northwestern Mutual The 2024 Planning & Progress Study, an annual research study from Northwestern Mutual, explores U.S. adults’ attitudes and behaviors toward money, financial decision-making, and the broader issues impacting people’s long-term financial security. Get the report here