Ndc Schemes and Heterogeneity in Longevity: Proposals for Redesign

By Robert Holzmann (University of Malaya; IZA Institute of Labor Economics; CESifo (Center for Economic Studies and Ifo Institute); World Bank), Jennifer Alonso-García (University of New South Wales (UNSW) – ARC Centre of Excellence in Population Ageing Research (CEPAR)), Heloise Labit-Hardy (University of New South Wales (UNSW) – ARC Centre of Excellence in Population Ageing Research (CEPAR)) & Andres Villegas (University of New South Wales (UNSW))

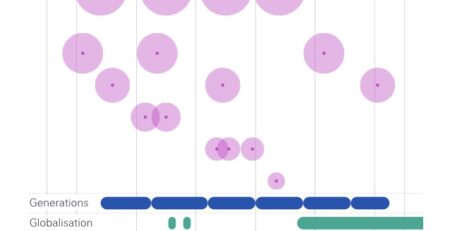

Strong and rising empirical evidence across countries finds that longevity is highly heterogeneous in key socioeconomic characteristics, including income. A positive relationship between lifetime income and life expectancy at retirement amounts to a straight tax/subsidy mechanism when the average cohort life expectancy is applied for annuity calculation, as done under nonfinancial defined contribution (NDC) schemes. Such a regressive redistribution and the ensuing labor market distortion put into doubt main features of the NDC scheme and call for alternative benefit designs to compensate for the heterogeneity. This paper explores five key mechanisms of compensation: individualized annuities; individualized contribution rates/account allocations; a two-tier contribution structure with socialized and individual rate structure; and two supplementary approaches under the two-tier approach to deal with the income distribution tails, and the distortions above a ceiling and below a floor. Using unique data from England and Wales and the United States, the analysis indicates that both individualized annuities and a two-tier contribution scheme are feasible and effective and thus promising policy options. To this end, however, a de-pooling of gender will be required.

Source: SSRN